What Is the Current Number of Refrigeration Parts Manufacturers in 2025

Key Takeaways

- By 2025, there will be over 10,000 refrigeration parts makers. This shows the industry is growing fast.

- More people want energy-saving systems. This pushes companies to make better, energy-efficient parts.

- New markets, especially in Asia-Pacific, are growing quickly. Investments in cold storage systems are increasing there.

- New tech like IoT and AI improves system performance. It also lowers costs, making systems more modern and efficient.

- Sustainability is very important now. Companies use eco-friendly materials and methods to follow rules and attract green-minded buyers.

Factors Shaping the Number of Refrigeration Parts Manufacturers

Market Trends

Rising demand for energy-efficient refrigeration systems

The growing emphasis on energy efficiency has significantly influenced the refrigeration industry. I have observed that consumers and businesses alike are prioritizing systems that reduce energy consumption. This trend has driven manufacturers to innovate and produce advanced components, such as high-efficiency heat exchangers and variable speed drives for compressors. The global energy efficiency technologies market, valued at 28.45billionin2023,isprojectedtogrowataCAGRof12.628.45 billion in 2023, is projected to grow at a CAGR of 12.6%, reaching 82.68 billion by 2030. This growth highlights the increasing demand for energy-efficient solutions, which directly impacts the number of refrigeration parts manufacturers.

Growth in cold chain logistics and storage solutions

The rise of e-commerce and food delivery services has fueled the expansion of cold chain logistics. I have noticed that industries like food and beverage, pharmaceuticals, and chemicals rely heavily on efficient refrigeration systems to maintain product quality. This demand has encouraged manufacturers to develop innovative solutions tailored to these sectors. For instance, the need for reliable refrigeration in logistics and retail has led to the production of modular and scalable systems. These advancements not only meet industry requirements but also create opportunities for new players to enter the market.

Technological Advancements

Adoption of IoT-enabled and smart refrigeration components

Technological innovation has transformed the refrigeration industry. IoT-enabled sensors now allow real-time monitoring and predictive maintenance, enhancing system performance and reducing downtime. I have seen how automation technologies optimize energy consumption and lower operational costs. These advancements, including AI-driven systems, have spurred growth in the industrial refrigeration parts market, which was valued at $24.3 billion in 2022 and is expected to grow at a CAGR of 5.8% from 2023 to 2030.

Development of sustainable and eco-friendly materials

Sustainability has become a cornerstone of modern manufacturing. I have observed that manufacturers are increasingly using advanced materials to improve thermal conductivity and extend component lifespans. Innovations like CO2 refrigerants and magnetic refrigeration demonstrate the industry's commitment to eco-friendly practices. These developments not only align with global environmental goals but also attract environmentally conscious consumers, further driving demand for refrigeration parts manufacturers.

Regulatory Environment

Impact of global environmental policies on refrigerants

Environmental regulations play a pivotal role in shaping the refrigeration industry. Policies like the AIM Act (2020) mandate the phasedown of hydrofluorocarbons (HFCs) by 85% by 2036. This has prompted manufacturers to transition to low-global-warming-potential (GWP) alternatives. Additionally, the EPA's HFC Rule restricts the use of high-GWP HFCs starting in 2025, encouraging innovation in refrigerant technology.

Compliance with energy efficiency standards

Energy efficiency standards have become increasingly stringent. I have noticed that manufacturers must now comply with regulations that promote sustainable practices. Supportive policies, such as tax incentives, further stimulate market demand for energy-efficient systems. These regulations not only drive innovation but also create economic opportunities for refrigeration parts manufacturers.

Challenges and Opportunities for Refrigeration Parts Manufacturers

Challenges

Increasing raw material costs

I have observed that rising raw material costs pose a significant challenge for refrigeration parts manufacturers. The HVAC industry depends heavily on materials like steel, aluminum, and copper. Global shortages of these materials have slowed production across multiple sectors, including refrigeration. Manufacturers face higher procurement costs, which directly impact their profit margins. Additionally, energy-efficient systems require substantial initial investments. Installation costs for these systems are 30-40% higher than traditional models, making it difficult for smaller businesses to adopt them.

Supply chain disruptions and geopolitical factors

Supply chain disruptions have become a persistent issue. Shortages of key components like compressors, electronic controls, and refrigerants delay production timelines. Geopolitical tensions exacerbate these challenges by creating uncertainties in trade policies and tariffs. For instance, the volatile global supply chain environment, influenced by climate change and geopolitical unrest, has made it harder for manufacturers to maintain consistent production. These disruptions not only affect availability but also increase operational costs for businesses.

Opportunities

Expansion in emerging markets

Emerging markets present immense growth potential for refrigeration parts manufacturers. Investments in cold chain logistics infrastructure are rapidly increasing, particularly in the Asia-Pacific region. This growth addresses the rising demand for food safety and vaccine distribution. Urbanization has also led to the expansion of supermarkets and retail outlets, each requiring refrigeration systems. These developments create opportunities for manufacturers to tap into new markets and expand their customer base.

| Opportunity | Description |

|---|---|

| Rising Demand for Cold Chain Logistics | Investments in cold chain logistics infrastructure are rapidly growing, especially in Asia-Pacific, to meet the needs of food safety and vaccine distribution. |

| Growth in the Pharmaceutical Industry | Increasing demand for specialized refrigeration systems in the pharmaceutical sector, particularly for vaccine storage, presents significant growth opportunities. |

Growing demand for customized refrigeration solutions

The demand for customized refrigeration solutions continues to grow. Customization allows manufacturers to tailor systems to specific applications, enhancing operational efficiency. For example, adapting refrigeration systems to environmental conditions ensures better performance and longevity. Tailored solutions also help businesses meet regulatory requirements and optimize energy efficiency. This approach increases system reliability and lifespan, making it a lucrative opportunity for manufacturers to differentiate themselves in a competitive market.

- Customization enables manufacturers to optimize energy efficiency, reducing operational costs.

- Tailored systems ensure compliance with industry standards and regulatory requirements.

- Adapting to environmental conditions improves system performance and longevity.

Regional Insights and Key Players in Refrigeration Parts Manufacturing

Regional Variations

Asia-Pacific as a manufacturing hub

Asia-Pacific has emerged as a dominant force in refrigeration parts manufacturing. I have observed that this region benefits from several competitive advantages, including low production costs and high manufacturing capacity. For instance, China leads the market due to its extensive production capabilities. Rapid urbanization and the growth of the food service industry further fuel demand for refrigeration components. Technological advancements in energy-efficient systems also position Asia-Pacific as a leader in meeting global environmental standards.

| Factor | Description |

|---|---|

| Manufacturing Capacity | China holds the largest share in the Asia-Pacific commercial refrigerator market due to enormous manufacturing capacity. |

| Affordable Production | The region benefits from low production costs, making it competitive in the global market. |

| Growth of Food Service Industry | Rapid growth in food service and retail industries increases demand for refrigeration parts. |

| Technological Advancements | Innovation in energy-efficient refrigeration systems meets strict environmental standards. |

| Urbanization | Rapid urbanization drives demand for cold storage solutions across various sectors. |

Growth in North America and Europe due to advanced technologies

North America and Europe have seen significant growth in refrigeration parts manufacturing, driven by advanced technologies. I have noticed that automation and AI play a pivotal role in enhancing operational efficiency. These technologies enable predictive maintenance through real-time monitoring, reducing downtime and optimizing energy consumption. Manufacturers in these regions focus on precision and sustainability, which aligns with the increasing demand for eco-friendly refrigeration systems. This technological edge ensures that North America and Europe remain competitive in the global market.

Key Players

Overview of leading global manufacturers

The refrigeration parts manufacturing industry features several prominent players. Companies like Carrier Corporation, Daikin Industries, and Johnson Controls lead the market with innovative and sustainable solutions. Carrier focuses on commercial refrigeration systems, while Daikin is known for its advanced inverter technology. Johnson Controls emphasizes sustainability across its product range. Other notable manufacturers include Anthony International, Emerson Climate Technologies, Inc., Bitzer SE, and Doucette Industries, Inc. These companies set industry benchmarks through their commitment to quality and innovation.

Role of SMEs in driving innovation and competition

Small and medium-sized enterprises (SMEs) play a crucial role in the refrigeration parts manufacturing sector. I have observed that SMEs often drive innovation by developing niche products and customized solutions. Their agility allows them to adapt quickly to market demands and regulatory changes. These businesses also foster competition, encouraging larger manufacturers to innovate and improve their offerings. SMEs contribute significantly to the industry's growth by addressing specific customer needs and exploring emerging markets.

Future Outlook for Refrigeration Parts Manufacturers

Industry Growth Projections

Expected CAGR and market expansion by 2025

I expect the refrigeration parts manufacturing industry to experience robust growth by 2025. The market size, valued at 123.45billionin2022,isprojectedtoreach123.45 billion in 2022, is projected to reach 198.76 billion by 2030. This represents a compound annual growth rate (CAGR) of 7.20% from 2024 to 2030. The commercial refrigeration equipment market alone is anticipated to grow at a CAGR of over 5.1% during this period. North America, with its focus on advanced technologies, is expected to achieve a CAGR of 6.1% between 2018 and 2025. These figures highlight the industry's potential for expansion, driven by technological advancements and increasing consumer demand.

Emerging trends influencing the future of manufacturing

Several trends will shape the future of refrigeration parts manufacturing. Companies are prioritizing energy efficiency and sustainability by investing in systems that reduce energy consumption and environmental impact. Smart technology, including IoT-enabled sensors, is becoming integral for real-time monitoring and predictive maintenance. Advanced materials are improving the efficiency and durability of refrigeration components. Modular and scalable systems are gaining popularity due to their flexibility. Additionally, the industry is focusing on health and safety by enhancing safety features and training programs. These trends will redefine manufacturing practices and create new opportunities for growth.

Innovations and Technological Advancements

Development of next-generation refrigeration technologies

Next-generation refrigeration technologies are revolutionizing the industry. CO2 refrigerants, with a Global Warming Potential (GWP) of only 1, offer a sustainable alternative to traditional HFCs. Thermoelectric cooling, which uses the Peltier effect, operates silently and efficiently, though it requires more electricity. Magnetic refrigeration, leveraging the magnetocaloric effect, represents another promising innovation. While it faces technical challenges, its potential for energy efficiency is significant. These advancements demonstrate the industry's commitment to sustainability and innovation.

Integration of AI and machine learning in manufacturing processes

Artificial intelligence (AI) and machine learning are transforming manufacturing processes. I have seen how these technologies optimize production by enabling predictive maintenance and improving quality control. AI-driven systems analyze vast amounts of data to identify inefficiencies and recommend solutions. Machine learning algorithms enhance automation, reducing human error and increasing productivity. These technologies also support the development of customized refrigeration solutions, meeting specific customer needs. The integration of AI and machine learning will continue to drive innovation and efficiency in the industry.

In 2025, the number of refrigeration parts manufacturers globally is projected to surpass 10,000, reflecting the industry's dynamic growth. This expansion stems from advancements in AI and automation, which improve efficiency and predictive maintenance. The rising demand for energy-efficient solutions and adherence to sustainability standards further shape the market.

The industry's future lies in leveraging innovation and adapting to change. Insights from thought leadership and R&D strategies emphasize the importance of embracing new technologies and shifting trends. By focusing on these opportunities, manufacturers can drive growth and maintain competitiveness in a rapidly evolving landscape.

| Source | Description |

|---|---|

| How to leverage change to impact the future | Insights on adapting to change and leveraging innovation for growth. |

| Thought Leadership | Strategies for adapting to new technologies as a leader. |

| Research and Development (R&D) | Adapting R&D strategies to shifting market trends. |

FAQ

What are the key drivers of growth in the refrigeration parts manufacturing industry?

The industry's growth stems from rising demand for energy-efficient systems, advancements in smart technologies, and the expansion of cold chain logistics. I have observed that sustainability and regulatory compliance also play significant roles in shaping market dynamics.

How do technological advancements impact refrigeration parts manufacturing?

Technological innovations, such as IoT-enabled components and AI integration, enhance efficiency and reliability. These advancements allow manufacturers to optimize production processes, reduce costs, and meet evolving consumer demands for smarter and more sustainable solutions.

Why is Asia-Pacific considered a hub for refrigeration parts manufacturing?

Asia-Pacific dominates due to its low production costs, high manufacturing capacity, and rapid urbanization. I have seen how the region's focus on energy-efficient technologies and growing food service industries further solidify its leadership in the global market.

What role does Ningbo Senjun New Materials Co., Ltd. play in the industry?

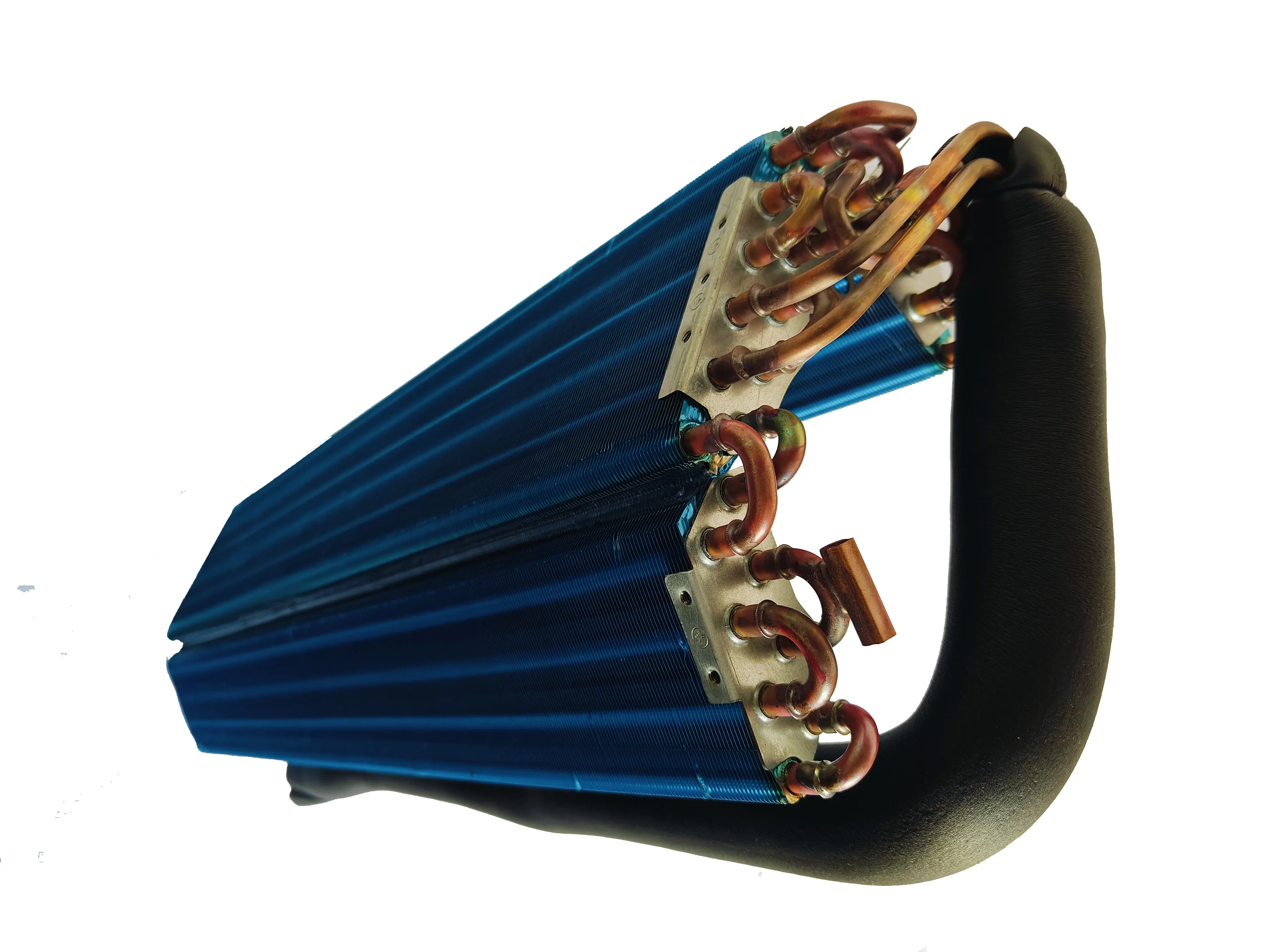

Ningbo Senjun specializes in producing wire tube condensers and copper aluminum fin heat exchangers. Their products cater to diverse applications, including refrigerators, freezers, and medical ultra-low temperature refrigerators, showcasing their commitment to innovation and quality.

How do global environmental policies influence the industry?

Environmental regulations drive the adoption of low-GWP refrigerants and energy-efficient systems. I have noticed that manufacturers must innovate to comply with these policies, which creates opportunities for sustainable growth and market differentiation.