2025 Global Refrigeration Accessories Market Forecast

The refrigeration accessories market plays a vital role in supporting industries like food and beverage, healthcare, and retail. Its significance stems from the growing need for efficient cooling systems across these sectors. By 2025, the market is expected to reach a valuation of $25 billion, growing at an annual rate of 4.5%. This growth reflects the increasing demand for energy-efficient appliances and advancements in smart home technology. Household applications currently dominate the market, holding a 55% share, while the commercial sector is expanding rapidly. Products like the Wire Tube Condenser are pivotal in meeting these evolving demands, ensuring optimal performance and energy efficiency.

Key Takeaways

- The refrigeration accessories market will hit $25 billion by 2025.

- It is growing each year at a rate of 4.5%.

- Energy-saving systems and smart tech are boosting demand in food, healthcare, and stores.

- Asia-Pacific leads with 40% of the market in 2023.

- Its growth rate is expected to be 8.5%.

- Important items like compressors and condensers help improve cooling and save energy.

- New markets give companies chances to grow and meet local needs.

Market Overview

Current Market Size and Growth Trends

The refrigeration accessories market has shown remarkable growth in recent years. I have observed that this growth is driven by increasing demand across commercial, industrial, and residential sectors. Key trends include the rising adoption of energy-efficient systems and the integration of smart technologies.

- The commercial refrigeration equipment market was valued at USD 49.32 billion in 2024 and is projected to grow at a CAGR of 5.3% through 2032.

- The global refrigerant market, valued at USD 14.26 billion in 2023, is expected to grow at a CAGR of 4.7% from 2024 to 2030.

These figures highlight the robust expansion of the refrigeration industry, which directly impacts the demand for accessories like compressors, valves, and wire tube condensers.

Projected Market Size by 2025

The market's future looks promising, with significant growth anticipated by 2025. Based on current projections, the refrigeration accessories market is expected to reach approximately $25 billion, growing at an annual rate of 4.5%. Below is a table summarizing the projected market size for related sectors:

| Year | Market Size (USD Billion) |

|---|---|

| 2024 | 49.32 |

| 2025 | 61.27 |

| 2032 | 84.5 |

This growth reflects the increasing reliance on refrigeration solutions across industries, particularly in food storage and healthcare.

Key Industries Driving Demand

Several industries are fueling the demand for refrigeration accessories. I have identified the following as the primary contributors:

- The food service industry, which is projected to grow by 10% in employment over the next decade, driving the need for advanced refrigeration solutions.

- Approximately 1.5 billion refrigerators are currently in use worldwide, showcasing the vast potential for accessory upgrades.

- The healthcare sector, with its reliance on cold storage for vaccines and medicines, continues to be a significant driver.

These industries underscore the critical role of refrigeration accessories in supporting global infrastructure and daily life.

Key Market Drivers and Restraints

Drivers of Market Growth

Increasing Demand for Cold Storage Solutions

I have observed that the growing need for cold storage solutions is a significant driver of the refrigeration accessories market. Urbanization has led to a surge in demand for space-efficient refrigeration systems. Additionally, the rise of e-commerce has increased the frequency of online shopping for refrigeration accessories, making them more accessible to consumers.

- Rising urbanization boosts demand for compact and efficient accessories.

- E-commerce trends enhance consumer confidence in purchasing accessories.

- Growing awareness of energy efficiency and sustainability shapes market preferences.

Technological Advancements in Refrigeration Systems

Innovations in refrigeration technology have transformed the industry. Features like IoT-enabled systems and smart shelves attract consumers seeking convenience and efficiency. These advancements not only improve performance but also align with the global push for sustainable solutions.

Growth in the Food and Beverage Industry

The food and beverage sector continues to expand, driving the need for advanced refrigeration systems. Cold storage solutions are essential for preserving perishable goods, ensuring quality, and meeting regulatory standards. This industry's growth directly correlates with the increasing demand for refrigeration accessories.

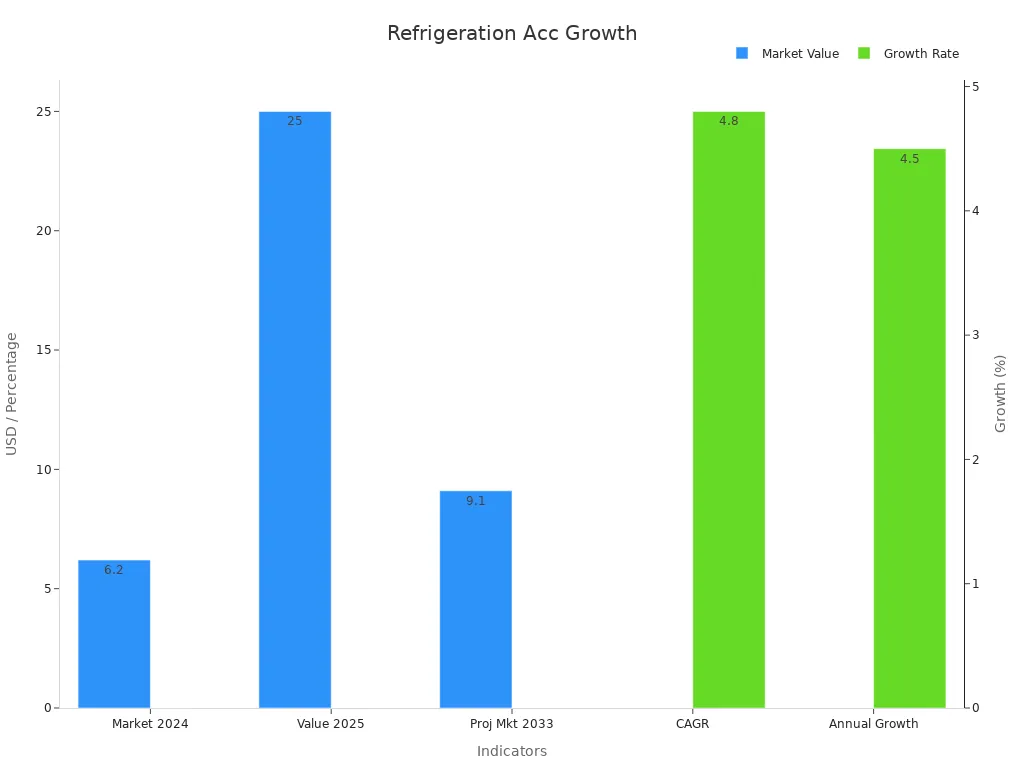

| Indicator | Value |

|---|---|

| Market Size (2024) | USD 6.2 Billion |

| Projected Market Size (2033) | USD 9.1 Billion |

| CAGR (2026-2033) | 4.8% |

| Estimated Market Value (2025) | Approximately USD 25 Billion |

| Annual Growth Rate | 4.5% |

Market Restraints

High Initial Costs of Advanced Accessories

The high cost of premium refrigeration accessories often deters consumers from making purchases. Budget constraints limit the adoption of advanced solutions, especially in developing markets.

Environmental Regulations and Compliance Challenges

Strict environmental regulations pose challenges for manufacturers. Compliance with these standards requires significant investment in research and development, which can increase production costs.

- Compatibility issues frustrate consumers and hinder purchases.

- Intense market competition erodes profit margins for new entrants.

- Lack of consumer awareness limits demand for innovative accessories.

These factors highlight the challenges that the refrigeration accessories market must navigate to sustain its growth trajectory.

Market Segmentation

Understanding market segmentation is crucial for analyzing the refrigeration accessories industry. I have observed that segmentation allows businesses to identify opportunities and tailor their strategies effectively. Below, I explore the market segmentation by type, material, and application.

By Type

Compressors

Compressors form the backbone of refrigeration systems. They regulate the flow of refrigerants, ensuring optimal cooling performance. The demand for compressors continues to grow due to their critical role in maintaining energy efficiency and system reliability.

Valves

Valves control the pressure and flow of refrigerants within refrigeration systems. Their precision and durability make them indispensable in both residential and industrial applications. I have noticed that advancements in valve technology are enhancing system performance and reducing energy consumption.

Filters

Filters play a vital role in maintaining system hygiene by removing impurities from refrigerants. Their importance has grown as industries prioritize sustainability and operational efficiency. Filters are particularly popular in healthcare and food storage applications.

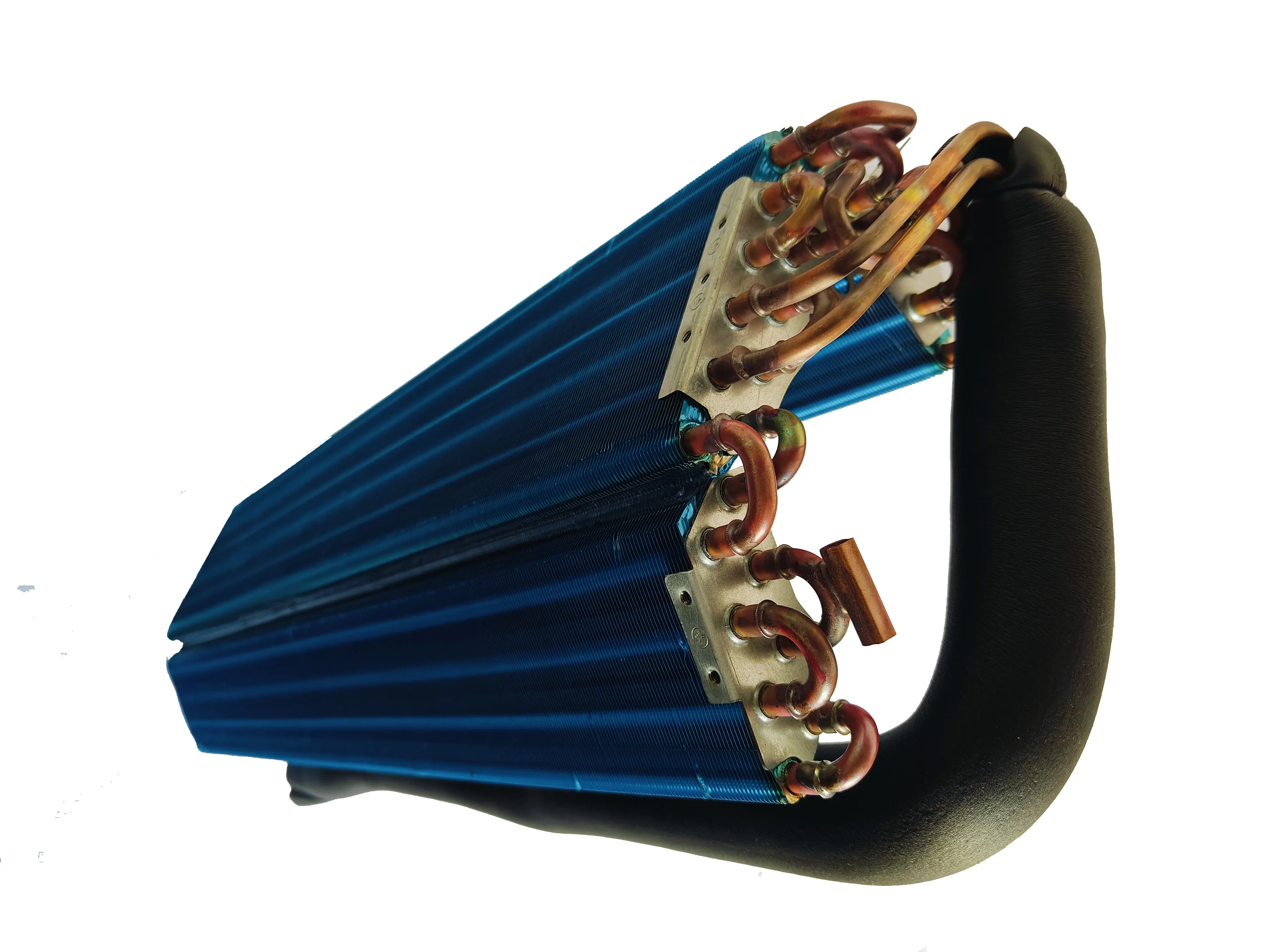

Wire Tube Condenser

The Wire Tube Condenser is a standout component in refrigeration systems. Its ability to dissipate heat efficiently makes it a preferred choice across industries. Companies like Ningbo Senjun New Materials Co., Ltd. specialize in producing high-quality wire tube condensers, which are widely used in refrigerators, freezers, and display cabinets. This component's versatility and reliability contribute significantly to its growing demand.

By Material

Metal

Metal-based accessories dominate the market due to their durability and thermal conductivity. Aluminum and copper are commonly used materials, especially in heat exchangers and condensers.

Plastic

Plastic components are lightweight and cost-effective, making them ideal for residential refrigeration systems. Their popularity is increasing as manufacturers develop more robust and eco-friendly plastic materials.

Other Materials

Other materials, such as composites, are gaining traction for their unique properties. These materials offer a balance between durability and weight, catering to specialized applications.

By Application

Commercial Refrigeration

Commercial refrigeration systems are essential for food service and retail industries. I have observed that these systems prioritize energy efficiency and reliability to meet the demands of high-traffic environments.

Industrial Refrigeration

Industrial refrigeration systems are designed for large-scale operations, such as food production and distribution. Their robust construction and advanced features make them suitable for heavy-duty applications.

Residential Refrigeration

Residential refrigeration systems focus on convenience and energy savings. The growing adoption of smart refrigerators highlights the importance of accessories like wire tube condensers in enhancing system performance.

By Geography

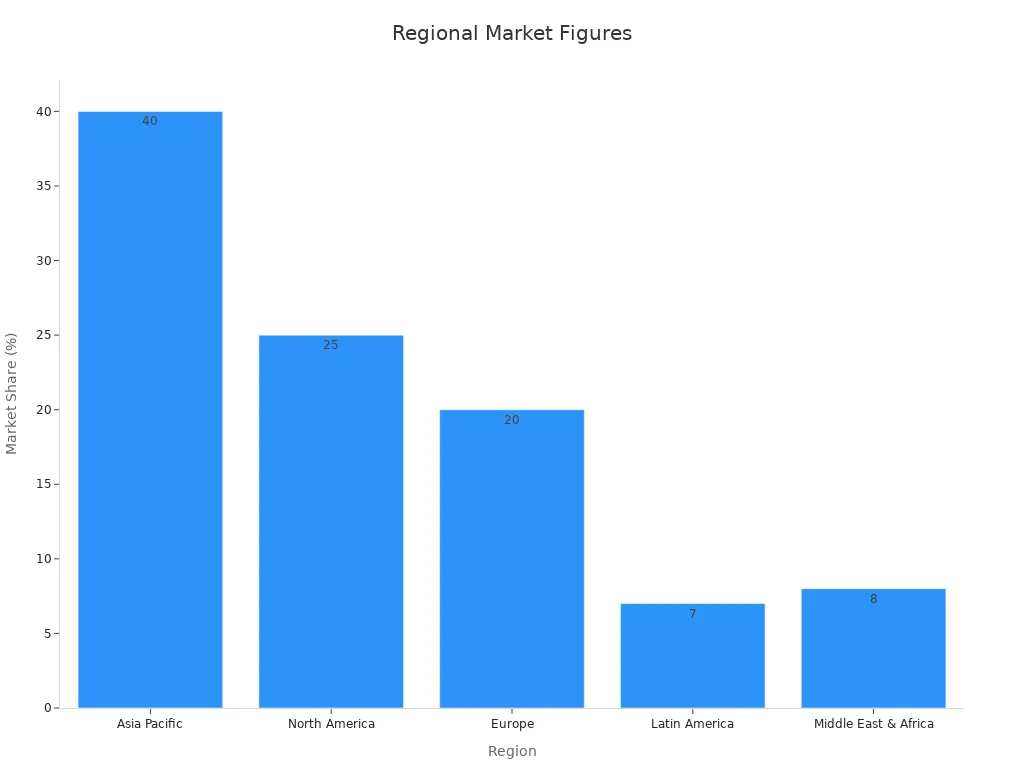

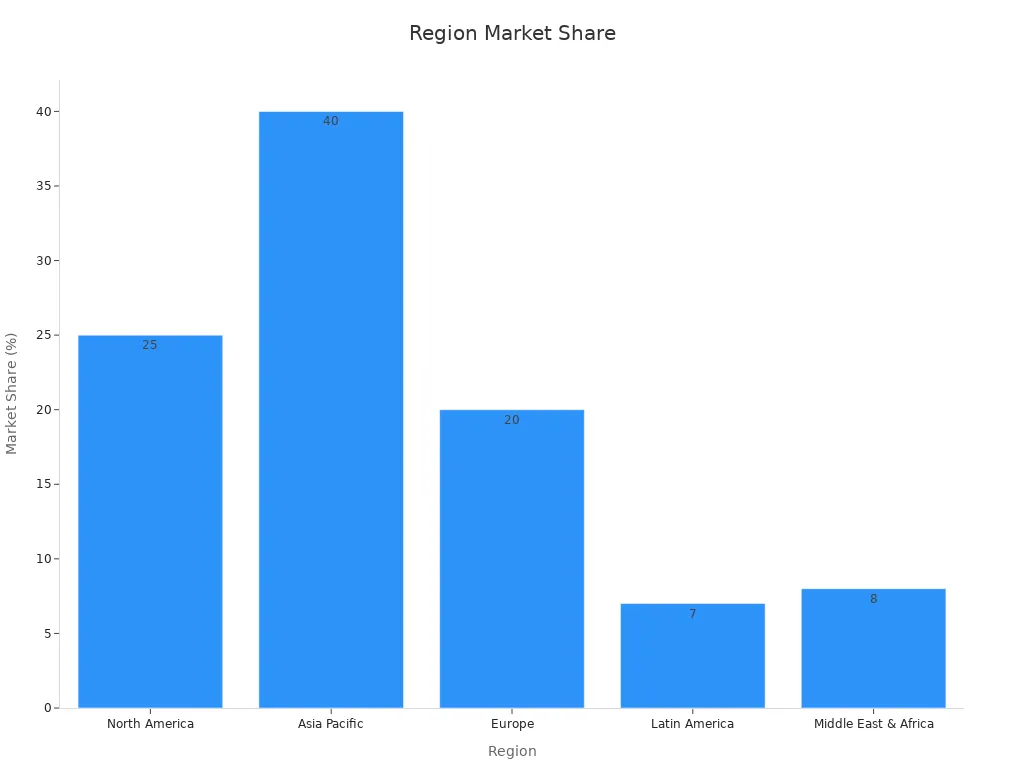

North America

North America holds a significant position in the refrigeration accessories market, accounting for 25% of the global share in 2023. The region benefits from a well-established cold chain infrastructure and a high demand for advanced refrigeration systems. I have observed that the food and beverage industry, along with the healthcare sector, drives much of this demand. The adoption of energy-efficient technologies is also a key trend here. Manufacturers are focusing on developing sustainable solutions to meet stringent environmental regulations.

Europe

Europe represents 20% of the global market share, with a strong emphasis on sustainable refrigeration technologies. Countries like Germany and France lead the way in adopting eco-friendly systems. I have noticed that the region's regulatory framework encourages innovation in energy-efficient accessories. Additionally, the growing popularity of smart refrigeration systems contributes to market growth. Companies in Europe are investing heavily in research and development to stay competitive.

Asia-Pacific

Asia-Pacific dominates the global market with a 40% share in 2023 and a projected CAGR of 8.5% from 2023 to 2030. Rapid industrialization and urbanization in countries like China and India fuel this growth. The region's expanding middle class drives demand for residential refrigeration systems. I have seen that emerging markets in Southeast Asia offer significant opportunities for manufacturers. The focus here is on affordable yet efficient accessories to cater to diverse consumer needs.

Latin America

Latin America accounts for 7% of the global market share. The food and beverage sector plays a crucial role in driving demand for refrigeration accessories. I have observed that countries like Brazil and Mexico are investing in cold chain logistics to support their agricultural exports. This creates opportunities for manufacturers to supply advanced refrigeration solutions tailored to the region's needs.

Middle East and Africa

The Middle East and Africa hold 8% of the market share. The increasing demand for cold chain logistics, particularly in the healthcare and food industries, drives growth in this region. I have noticed that the adoption of modern refrigeration systems is gaining momentum, especially in urban centers. Manufacturers are focusing on providing durable and energy-efficient accessories to meet the region's unique challenges, such as high temperatures and limited infrastructure.

| Region | Market Share (2023) | CAGR (2023-2030) |

|---|---|---|

| Asia Pacific | 40% | 8.5% |

| North America | 25% | N/A |

| Europe | 20% | N/A |

| Latin America | 7% | N/A |

| Middle East & Africa | 8% | N/A |

Regional Analysis

North America

Market Trends and Growth Drivers

North America remains a key player in the refrigeration accessories market. The region benefits from a well-established cold chain infrastructure and a growing demand for energy-efficient appliances. I have observed that the market is projected to grow at a compound annual growth rate (CAGR) of 4.5%, reaching approximately $25 billion by 2025. This growth aligns with the increasing adoption of advanced refrigeration systems in industries like food and beverage and healthcare.

- The market size was $6.2 billion in 2024 and is expected to reach $9.1 billion by 2033, with a CAGR of 4.8% from 2026 to 2033.

- Rising urbanization and the expansion of e-commerce platforms further fuel demand for refrigeration accessories.

Key Challenges in the Region

Despite its growth potential, the North American market faces challenges. High initial costs of advanced refrigeration accessories deter some consumers, particularly small businesses. Additionally, stringent environmental regulations require manufacturers to invest heavily in research and development, increasing production costs. These factors create barriers for new entrants and limit the adoption of innovative solutions.

Europe

Adoption of Sustainable Refrigeration Technologies

Europe leads the way in adopting sustainable refrigeration technologies. Countries like Germany, which holds a 25% revenue share in the region, prioritize eco-friendly solutions. The market is projected to grow from $61.27 billion in 2025 to $84.5 billion by 2032, with a CAGR of 4.7%. This growth reflects the region's commitment to reducing carbon emissions and enhancing energy efficiency.

| Year Range | Market Value (USD) | CAGR (%) |

|---|---|---|

| 2025-2032 | 61.27 Bn - 84.5 Bn | 4.7 |

Regional Market Leaders

Germany and France dominate the European market, driving innovation in refrigeration accessories. I have noticed that companies in these countries invest heavily in research and development to meet regulatory standards and consumer expectations. Their focus on smart and sustainable technologies positions them as leaders in the global market.

Asia-Pacific

Rapid Industrialization and Urbanization

Asia-Pacific holds the largest market share, accounting for 40% in 2023. Rapid industrialization and urbanization in countries like China and India drive this growth. The region's projected CAGR of 8.5% from 2023 to 2030 highlights its potential as the fastest-growing market for refrigeration accessories.

| Statistic | Value |

|---|---|

| Projected Market Growth Rate | 4.5% annually |

| Estimated Market Valuation by 2025 | Approximately $25 billion |

| Asia Pacific Market Share (2023) | 40% |

| Fastest Growing Region CAGR | 8.5% from 2023 to 2030 |

Emerging Markets in the Region

Emerging markets in Southeast Asia offer significant opportunities for manufacturers. I have observed that the demand for affordable yet efficient refrigeration accessories is rising, driven by an expanding middle class. Companies focusing on cost-effective solutions can capitalize on this growing consumer base.

Latin America

Growth Opportunities in the Food and Beverage Sector

Latin America presents significant growth opportunities in the refrigeration accessories market, particularly within the food and beverage sector. I have observed that this region's agricultural abundance and increasing export activities drive the demand for advanced refrigeration solutions. The food and beverage industry relies heavily on cold storage and transportation refrigeration equipment to maintain product quality and comply with international standards.

The market's potential becomes evident when examining the data. In 2023, the sector generated revenue of USD 1,739.0 million, with a projected CAGR of 6.5% from 2024 to 2030. Mexico stands out as the country with the highest growth rate during this period. Transportation refrigeration equipment emerges as the fastest-growing segment, reflecting the region's focus on improving logistics and supply chain efficiency.

| Metric | Value |

|---|---|

| Revenue in 2023 | USD 1,739.0 million |

| Expected CAGR from 2024 to 2030 | 6.5% |

| Largest revenue-generating product (2023) | Other equipment |

| Fastest growing segment | Transportation Refrigeration Equipment |

| Country with highest CAGR (2024-2030) | Mexico |

I believe the region's growing middle class and urbanization further amplify the demand for refrigeration accessories. Consumers increasingly prefer fresh and frozen food products, which require reliable cold storage solutions. Manufacturers focusing on energy-efficient and durable accessories can capitalize on this expanding market. Latin America’s food and beverage sector offers a promising avenue for growth, making it a key area of interest for industry players.

Middle East and Africa

Increasing Demand for Cold Chain Logistics

The Middle East and Africa region exhibit a rising demand for cold chain logistics, driven by the growth of industries such as healthcare, food, and hospitality. I have noticed that countries like Saudi Arabia and Turkey are experiencing significant increases in market growth due to the expanding packaged food industry and the rising number of hotels and restaurants. Egypt, as an emerging economy, also contributes to this upward trend.

The region's market dynamics reveal a diverse range of opportunities. For instance, Saudi Arabia's demand stems from its hospitality sector, while Turkey focuses on packaged food. Egypt and other African nations emphasize improving their cold chain infrastructure to support economic development.

| Country | Market Growth (2020-2026) | Key Drivers |

|---|---|---|

| Saudi Arabia | Significant increase | Demand from hotels & restaurants |

| Turkey | Significant increase | Demand from packaged food industry |

| Egypt | Significant increase | Emerging economy |

| Rest of MEA | Significant increase | Overall market growth |

I believe the region's climatic conditions and growing population further underscore the importance of efficient refrigeration systems. Manufacturers who prioritize durable and energy-efficient accessories tailored to these unique challenges can gain a competitive edge. The Middle East and Africa region hold immense potential for growth, particularly in cold chain logistics, making it a critical focus for the refrigeration accessories market.

Competitive Landscape

Major Players in the Market

Overview of Key Companies

The global refrigeration accessories market is highly competitive, with several major players dominating the landscape. These companies leverage their extensive expertise, robust supply chains, and innovative product portfolios to maintain their leadership positions. Their focus on energy-efficient solutions and smart technologies aligns with the growing consumer demand for sustainable and advanced refrigeration systems.

Market Share Analysis

The market analysis highlights the dominance of key players, who collectively hold a significant share of the global market. Their financial performance and consistent growth trends underscore their strong foothold. With the market projected to grow at an annual rate of 4.5% and reach $25 billion by 2025, these companies are well-positioned to capitalize on the increasing demand for refrigeration accessories. The presence of approximately 1.5 billion refrigerators worldwide further emphasizes the vast potential for accessory upgrades.

Strategies Employed by Leading Companies

Product Innovation and Development

Leading companies prioritize innovation to stay ahead in the competitive landscape. They invest heavily in research and development to create cutting-edge products that enhance energy efficiency and system performance. For instance, advancements in Wire Tube Condenser technology have significantly improved heat dissipation, making refrigeration systems more reliable and efficient.

Strategic Partnerships and Collaborations

Collaborations with other industry leaders and suppliers enable companies to expand their market reach and streamline operations. These partnerships often focus on developing sustainable solutions and meeting the evolving needs of consumers across different regions.

Expansion into Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Africa present lucrative opportunities for growth. Companies are actively expanding their presence in these regions by offering affordable and efficient refrigeration accessories tailored to local demands. This strategy not only boosts market share but also strengthens their global footprint.

Spotlight on Senjun

Overview of Senjun's Contributions

Ningbo Senjun New Materials Co., Ltd. stands out as a key contributor to the refrigeration accessories market. The company specializes in the research, development, and production of high-quality Wire Tube Condensers and copper aluminum fin heat exchangers. These products cater to a wide range of applications, including refrigerators, freezers, display cabinets, and medical ultra-low temperature refrigerators.

Focus on Wire Tube Condensers and Heat Exchangers

Senjun's Wire Tube Condensers exemplify the company's commitment to innovation and quality. These components play a crucial role in ensuring optimal cooling performance and energy efficiency. By focusing on advanced materials and manufacturing techniques, Senjun has established itself as a trusted name in the industry. Its heat exchangers further enhance system reliability, making them indispensable in both residential and commercial refrigeration systems.

The refrigeration accessories market is on track to achieve remarkable growth, with a projected valuation of $25 billion by 2025 and an annual growth rate of 4.5%. This expansion stems from rising demand across industries like food and beverage, healthcare, and residential refrigeration. Asia-Pacific leads the charge with a 40% market share in 2023 and a CAGR of 8.5%, while North America and Europe follow with 25% and 20%, respectively.

| Statistic | Value |

|---|---|

| Projected Annual Growth Rate | 4.5% |

| Projected Market Valuation by 2025 | $25 billion |

| Fastest Growing Region | Asia Pacific (CAGR of 8.5%) |

| Market Share by Region (2023) | North America: 25% |

| Asia Pacific: 40% | |

| Europe: 20% | |

| Latin America: 7% | |

| Middle East & Africa: 8% | |

| Fastest Growing Sub-segment | FridgeCool Fans (CAGR of 9.2%) |

| Key Applications Share (2023) | Household: 55% |

| Commercial: 30% | |

| Laboratory Use: 15% |

I believe competitive strategies, such as product innovation and expansion into emerging markets, will shape the industry's future. Companies like Senjun, with their focus on high-quality wire tube condensers and heat exchangers, exemplify the innovation driving this market forward. The future holds immense opportunities for businesses that prioritize sustainability, efficiency, and adaptability.

FAQ

What are refrigeration accessories, and why are they important?

Refrigeration accessories include components like compressors, valves, and wire tube condensers. These parts ensure the efficient operation of refrigeration systems. I believe they play a critical role in maintaining temperature control, energy efficiency, and system reliability across industries like food storage, healthcare, and residential applications.

How does the wire tube condenser contribute to refrigeration systems?

The wire tube condenser dissipates heat effectively, ensuring optimal cooling performance. Companies like Senjun specialize in producing high-quality wire tube condensers. These components enhance energy efficiency and reliability, making them indispensable for refrigerators, freezers, and display cabinets.

Which industries drive the demand for refrigeration accessories?

The food and beverage industry, healthcare, and retail sectors drive demand. I’ve observed that cold storage solutions for perishable goods and vaccines are essential. Additionally, the rise of e-commerce and urbanization has increased the need for advanced refrigeration systems.

What makes Senjun a key player in the market?

Senjun focuses on innovation and quality. Their expertise in wire tube condensers and copper aluminum fin heat exchangers supports diverse applications, from medical refrigerators to display cabinets. Their commitment to advanced materials and manufacturing techniques sets them apart in the industry.

How is the market expected to grow by 2025?

The refrigeration accessories market is projected to reach $25 billion by 2025, growing at an annual rate of 4.5%. I attribute this growth to rising demand for energy-efficient systems, technological advancements, and expanding applications in industries like food storage and healthcare.